ComplyRight 2024 1095-B Tax Form, 1-Part, 2-Up, 500/Pack (1095BCBLK500) Best

$132.00 $83.00

The ComplyRight Form 1095-B is used to report certain information to the IRS and to taxpayers about individuals who are …

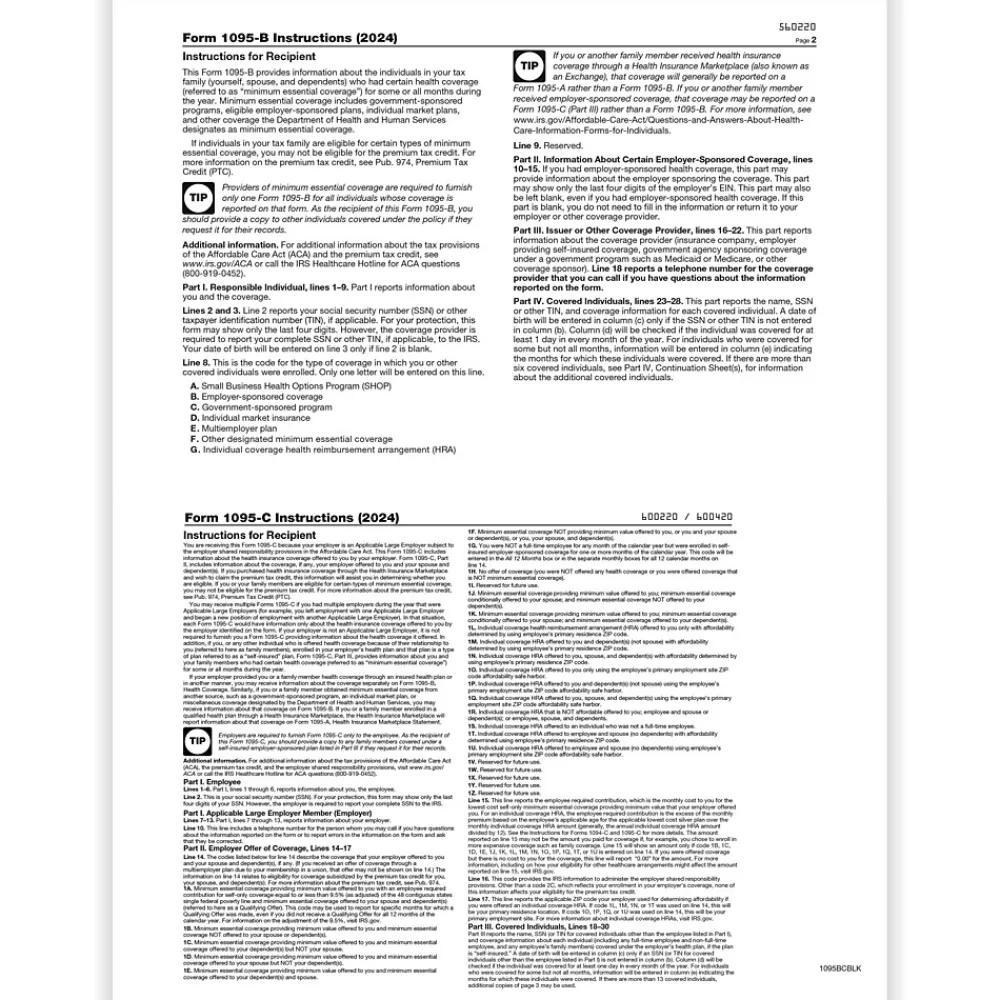

The ComplyRight Form 1095-B is used to report certain information to the IRS and to taxpayers about individuals who are covered by minimum essential coverage. Every person that provides minimum essential coverage to an individual during a calendar year must file an information return reporting the coverage. Filers will use the Form 1094-B (transmittal) to submit Forms 1095-B (returns). Small employers that aren’t subject to the employer shared responsibility provisions sponsoring self-insured group health plans should use Forms 1094-B and 1095-B to report information about covered individuals. Employers with 50 or more full-time employees (including full-time equivalent employees) use the Forms 1094-C and 1095-C to report the information required under sections 6055 and 6056 about offers of health coverage and enrollment in health coverage for their employees. The Form 1094-C must be used to report to the IRS summary information for each Applicable Large Employer (ALE) and to transmit Forms 1095-C to the IRS. These forms are also used in determining whether an ALE member owes a payment under the employer shared responsibility provisions under section 4980H. The Form 1095-C is also used in determining the eligibility of employees for the premium tax credit.

- File the blank Form 1095-B and Form 1095-C with pressure seals and backer instructions according to the IRS guidelines

- 2-up format: one sheet equals two forms

- 500 tax forms per pack

| Attribute name | Attribute value |

|---|---|

| Tax Form Pack Size | 11 |

| Number of Recipient or Employees

The different types of selling UOM: Pack, Case, Carton, etc

|

Pack |

| Number of Parts

Actual manufacturer name for the color of the product.

|

White/Black |

| Acid Free

The tax year the form is applicable to.

|

2024 |

| Width in Inches | Laser |

| Tax Form Type | 1095-B |

Be the first to review “ComplyRight 2024 1095-B Tax Form, 1-Part, 2-Up, 500/Pack (1095BCBLK500) Best” Cancel reply

Related products

Copy & Printer Paper

Copy & Printer Paper

Staples 8.5″ x 11″ Multipurpose Paper, 22 lbs., 98 Brightness, 2500/Carton (16345-US) Cheap

Copy & Printer Paper

Copy & Printer Paper

Hammermill 8.5″ x 11″ Multipurpose Paper, 65 lbs., Blue, 250 Sheets/Ream, 2 Reams/Pack (400520) New

Construction Paper

Pacon Tru-Ray 12″ x 18″ Construction Paper, Gold, 50 Sheets/Pack, 3/Pack (PAC102998) Cheap

Reviews

There are no reviews yet.